- ホーム

- > 洋書

- > 英文書

- > Business / Economics

Full Description

Accountants have historically had an important role in the detection and deterrence of fraud. As Joe Wells' Principles of Fraud Examination, 4th Edition illustrates, fraud is much more than numbers; books and records don't commit fraud - people do. Widely embraced by fraud examination instructors across the country, Principles of Fraud Examination, 4th Edition, by Joseph Wells, is written to provide a broad understanding of fraud to today's accounting students - what it is and how it is committed, prevented, detected, and resolved. This 4th Edition of the text includes a chapter on frauds perpetrated against organizations by individuals outside their staff—a growing threat for many entities as commerce increasingly crosses technological and geographical borders.

Contents

CHAPTER 1 INTRODUCTION 3

CHAPTER 2 SKIMMING 51

CHAPTER 3 CASH LARCENY 75

CHAPTER 4 BILLING SCHEMES 93

CHAPTER 5 CHECK TAMPERING 121

CHAPTER 6 PAYROLL SCHEMES 155

CHAPTER 7 EXPENSE REIMBURSEMENT SCHEMES 179

CHAPTER 8 REGISTER DISBURSEMENT SCHEMES 197

CHAPTER 9 NONCASH ASSETS 213

CHAPTER 10 CORRUPTION 239

CHAPTER 11 ACCOUNTING PRINCIPLES AND FRAUD 273

CHAPTER 12 FINANCIAL STATEMENT FRAUD SCHEMES 301

CHAPTER 13 EXTERNAL FRAUD SCHEMES 349

CHAPTER 14 FRAUD RISK ASSESSMENT 367

CHAPTER 15 CONDUCTING INVESTIGATIONS AND WRITING REPORTS 391

CHAPTER 16 INTERVIEWING WITNESSES 417

CHAPTER 17 OCCUPATIONAL FRAUD AND ABUSE: THE BIG PICTURE 443

APPENDIX A ONLINE SOURCES OF INFORMATION 457

APPENDIX B SAMPLE CODE OF BUSINESS ETHICS AND CONDUCT 467

APPENDIX C FRAUD RISK ASSESSMENT TOOL 481

BIBLIOGRAPHY 511

INDEX 513

-

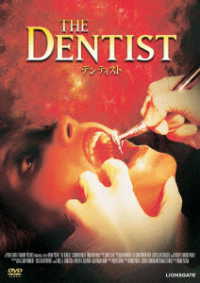

- DVD

- デンティスト