- ホーム

- > 洋書

- > 英文書

- > Business / Economics

基本説明

New in paperback. Hardcover was published in 1996. An overview of the classical gold standard, a survey of the relevant applied research in international macroeconomics, and a demonstration of how the past can help to inform the present.

Full Description

Currency crises in Europe and Mexico during the 1990s provided stark reminders of the importance and the fragility of international financial markets. These experiences led some commentators to conclude that open international capital markets are incompatible with financial stability. But the pre-1914 gold standard is an obvious challenge to the notion that open capital markets are sources of instability. To deepen our understanding of how this system worked, this volume draws together recent research on the gold standard. Theoretical models are used to guide qualitative discussions of historical experience, while econometric methods are used to help the historical data speak clearly. The result is an overview of the gold standard, a survey of the relevant applied research in international macroeconomics, and a demonstration of how the past can help to inform the present.

Contents

Part I. Introduction: 1. Modern perspectives on the gold standard. Introduction Tamim Bayoumi, Barry Eichengreen and Mark P. Taylor; 2. Unit roots, shocks and VARs and their place in history: an introductory guide Terence C. Mills; Part II. Operation of the Gold Standard: 3. The gold standard as a commitment mechanism Michael D. Bordo and Finn E. Kydland; 4. Market efficiency and regime efficiency under the 1925-1931 dollar/sterling gold standard Lawrence H. Officer; 5. Credibility and fundamentals: were the Classical and interwar gold standards well-behaved target zones? C. Paul Hallwood, Ronald MacDonald and Ian W. Marsh; Part III. Adjustment Mechanisms: 6. The stability of the gold standard and the evolution of the International Monetary Fund Tamim Bayoumi and Barry Eichengreen; 7. International adjustment under the Classical gold standard: evidence for the United States and Britain, 1879-1914 Charles W. Calomaris and R. Glenn Hubbard; 8. Balance of payments adjustments under the gold standard policies: Canada and Australia compared Trevor J. O. Dick, John E. Floyd and David Pope; Part IV. Monetary Issues: 9. Money demand and supply under the gold standard: United Kingdom 1870-1914 Forrest H. Capie and Geoffrey E. Wood; 10. Stability and forward-looking behaviour: the demand for broad money in the United Kingdom 1871-1913 Mark P. Taylor and Geoffrey E. Wood; Part V. Exchange Rate Behavior: 11. The dollar/pound exchange rate and fiscal policy during the gold standard period Graciela L. Kaminsky and Michael Klein; 12. Exchange rate dynamics and monetary reforms: theory and evidence from Britain's return to gold Panos Michael, A. Robert Nobay and David Peel; 13. Conclusion: Déjà vu all over again: lessons from the gold standard for European monetary unification Barry Eichengreen.

-

- 洋書

- EN DIALOGUE

-

- 洋書

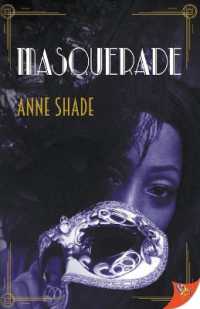

- Masquerade