- ホーム

- > 洋書

- > 英文書

- > Business / Economics

Full Description

This book is about championing a move away from simply evaluating physical assets to understanding and evaluating the intangible value of an entity. It means moving beyond economic theory to reprioritise and change the organisation so that further value can be created via processes, systems, measures, skills, knowledge and strategy. It is also about mapping the intangible value chain. The book looks at value networks and, using real-life projects asks questions such as:

What do company value networks look like

How are they used to create value

How can one 'value' the value chain

What lessons can be learnt from companies with high value networks as opposed to companies with low value networks

What is the impact on finance disciplines, processes, measures, systems and skills.

These answers to these questions as provided by the case studies and interviews with CFOs from the companies involved will help to improve focus, improve shareholder value, improve transparency - both internally and externally - cut waste in the current decision support structure and prevent inadequate decision making and lost opportunity.

Contents

1. Today's Challenges, Tomorrow's AspirationToday's Aspirations. Riding the two-headed monster.

Getting "back in the saddle".

Coping with governance and reporting.

Creating value and growth.

Shaping the new agenda.

Straight from the CFO.

2. Reshaping Finance.

Centralization: where to draw the line?

The quest for standardization.

The new fi nancial management model.

Process optimization and reporting.

Streamlining corporate structure.

Lessons from private equity.

Straight from the CFO.

3. Making Change Happen.

Change, in a hurry.

Champions of change.

Transforming the public sector.

Pulling all change levers.

From CFO to COO.

Talent for the future.

Straight from the CFO.

4. Releasing Intangible Value.

Execution not valuation.

The goodwill dilemma.

Value centers.

Managing intellectual property.

Selecting valuation techniques.

Brands: the missing half of the balance sheet!

Treating customers as assets.

Value tiering.

Moving from back offi ce to the front.

Structural and human capital.

Straight from the CFO.

5. Driving Growth and Innovation.

Sustainable advantage.

Decision support takes center stage.

New ways of working.

In-market innovation.

From the outside, in.

Innovation centers: a "win-win".

Straight from the CFO.

6. Looking Forward, Not Backward.

Expect the unexpected.

Closing the strategy gap in pharmaceuticals.

Optimizing value through integration.

Rolling forecasts.

Monitoring reality.

Connecting the dots through systems.

Straight from the CFO.

7. Innovative Business Partnering.

Finance of the future.

Working in partnership.

Effective investment in brands.

Decision making under uncertainty.

Finance and innovation.

Dynamic performance management.

The finance academy.

Conclusion.

Straight from the CFO.

8. Promoting Global Connectivity.

Building global partnerships.

Integrating shared services by region.

Creating a worldwide center.

Seamless support: near-shore or off-shore?

Connectivity through technology.

Straight from the CFO.

9. Leveraging Risk and Regulation.

The misery of regulation.

Leveraging Sarbanes-Oxley.

Multiple listings, multiple standards.

Implementation overload.

The case for dual accounting.

Enterprise-wide risk management.

The role of Chief Risk Offi cer (CRO).

Straight from the CFO.

10. Becoming a Sustainable Corporation.

Case for corporate responsibility.

Investor perspective.

Ethics and value creation.

A multi-stakeholder approach.

Best practices: corporate reporting.

Triple bottom line.

Reality check.

Becoming the good corporation!

Straight from the CFO.

Index.

-

- 電子書籍

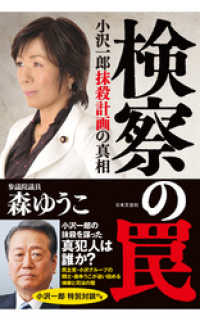

- 検察の罠