- ホーム

- > 洋書

- > 英文書

- > Business / Economics

Full Description

NOTE: Before purchasing, check with your instructor to ensure you select the correct ISBN. Several versions of the MyLab™and Mastering™ platforms exist for each title, and registrations are not transferable. To register for and use MyLab or Mastering, you may also need a Course ID, which your instructor will provide.

Used books, rentals, and purchases made outside of Pearson

If purchasing or renting from companies other than Pearson, the access codes for the MyLab platform may not be included, may be incorrect, or may be previously redeemed. Check with the seller before completing your purchase.

For courses in intermediate accounting.

This package includes MyLab Accounting.

Help students think like accountants -- from the first day of class through their careers

Thinking like an accountant isn't just rote memorization of accounting rules. Rather, it's developing the judgment and decision-making skills needed to form accounting estimates and evaluate financial statements critically. With its focus on conceptual framework fundamentals and critical thinking, Gordon, Raedy, and Sannella's Intermediate Accounting, 2nd Edition gives readers the opportunity to develop problem-solving skills, apply their judgment, and work with real company financials. After mastering these essential skills, students will be ready to pass the CPA exam, and able to think like accountants.

Personalize learning with MyLab Accounting

By combining trusted authors' content with digital tools and a flexible platform, MyLab personalizes the learning experience and improves results for each student.

0134833104 / 9780134833101 Intermediate Accounting Plus MyLab Accounting with Pearson eText -- Access Card Package, 2/e

Package consists of:

0134730372 / 9780134730370 Intermediate Accounting

0134732383 / 9780134732381 MyLab Accounting with Pearson eText -- Access Card -- for Intermediate Accounting

Contents

1. The Financial Reporting Environment

2. Financial Reporting Theory

3. Judgment and Applied Financial Accounting Research

4. Review of the Accounting Cycle

5. Statements of Net Income and Comprehensive Income

6. Statements of Financial Position and Cash Flows and the Annual Report

7. Accounting and the Time Value of Money

8. Revenue Recognition (New Converged Standard)

Revenue Recognition (Current Standards) Online

9. Short-Term Operating Assets: Cash and Receivables

10. Short-Term Operating Assets: Inventory

11. Long-Term Operating Assets: Acquisition, Cost Allocation, and Derecognition

12. Long-Term Operating Assets: Departures from Historical Cost

13. Operating Liabilities and Contingencies

Appendix: Accounting for Warranty Costs (Current Standards) Online

14. Financing Liabilities

15. Accounting for Stockholders' Equity

16. Investing Assets

17. Accounting for Income Taxes

18. Accounting for Leases (New Standard)

Accounting for Leases (Current Standards) Online

19. Accounting for Employee Compensation and Benefits

20. Earnings per Share

21. Accounting Changes and Error Analysis

22. The Statement of Cash Flows

-

- 電子書籍

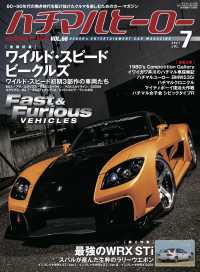

- ハチマルヒーロー vol.66

-

- DVD

- ストレート・トゥ・ヘル